In today's fast-paced financial landscape, finding the right budgeting tool is essential for effective money management. Mint Finance Alternatives offer users a variety of options to track their finances, set budgets, and achieve their financial goals. As more individuals seek ways to manage their finances efficiently, the demand for reliable financial tools has surged. This article delves into the top alternatives to Mint, providing insights into their features, benefits, and how they can help you take control of your financial future.

With the rise of various financial management apps, users are often overwhelmed by the number of options available. Each app comes with its unique features catering to different financial needs, from simple budgeting to comprehensive investment tracking. This article will guide you through some of the best Mint alternatives that can help you streamline your finances, ensuring you find a tool that meets your specific requirements.

Whether you're a seasoned investor or just starting your budgeting journey, understanding these alternatives will empower you to make informed decisions about your financial health. Let's explore some of the best Mint Finance Alternatives that can help you achieve better financial management.

Table of Contents

- What is Mint?

- Why Consider Mint Finance Alternatives?

- Top Mint Finance Alternatives

- Features to Look For in Finance Apps

- Conclusion

What is Mint?

Mint is a popular personal finance app that allows users to track their spending, create budgets, and manage their financial accounts in one place. Launched in 2006 and acquired by Intuit in 2009, Mint has become a go-to tool for many individuals seeking to gain better control over their finances. The app provides users with an overview of their financial situation by aggregating data from various bank accounts, credit cards, and investments.

Why Consider Mint Finance Alternatives?

While Mint is a powerful tool, it may not meet everyone's needs. Here are several reasons why you might consider exploring Mint finance alternatives:

- Privacy Concerns: Some users have concerns about data security and privacy when using Mint, especially given its connection to third-party financial institutions.

- Feature Limitations: Certain features available in other apps may be absent in Mint, such as advanced investment tracking or customizable budgeting options.

- User Experience: Users may prefer different interfaces or user experiences that are more intuitive or tailored to their specific preferences.

- Cost: While Mint is free, some alternatives offer premium features for a fee, which may provide better value depending on your financial management needs.

Top Mint Finance Alternatives

1. You Need A Budget (YNAB)

You Need A Budget (YNAB) is a popular budgeting tool that emphasizes proactive financial management. Unlike traditional budgeting tools, YNAB encourages users to allocate every dollar they earn to a specific purpose, fostering a sense of financial discipline.

- Key Features:

- Real-time budgeting and tracking.

- Goal-setting options for savings and debt repayment.

- Educational resources and support through workshops and tutorials.

- Pricing: YNAB offers a free trial, followed by a subscription fee of $14.99 per month or $98.99 per year.

2. Personal Capital

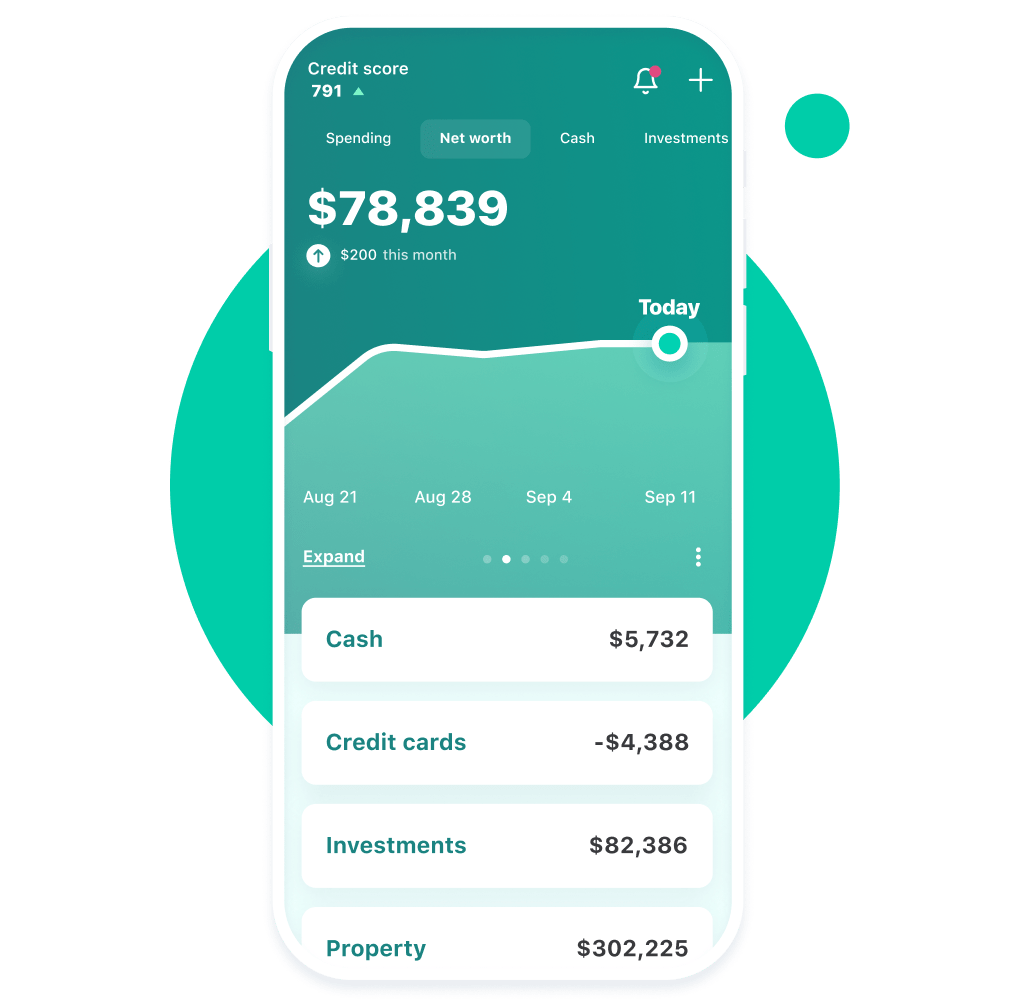

Personal Capital combines budgeting and investment tracking, making it a comprehensive financial management tool. This platform is ideal for users looking to manage their spending while also monitoring their investment portfolios.

- Key Features:

- Investment tracking and analysis tools.

- Retirement planning calculators.

- Net worth tracking and cash flow analysis.

- Pricing: Personal Capital is free to use, with optional wealth management services available for a fee.

3. PocketGuard

PocketGuard is a budgeting app designed to simplify money management. It helps users understand how much disposable income they have after accounting for bills, goals, and necessities.

- Key Features:

- Automatic categorization of spending.

- Customizable spending limits.

- Insights into recurring bills and subscriptions.

- Pricing: PocketGuard offers a free version, with a premium subscription available for $4.99 per month or $34.99 per year.

4. EasyBudget

EasyBudget focuses on providing a straightforward budgeting experience. It allows users to track their income and expenses easily, making it suitable for individuals who prefer simplicity over advanced features.

- Key Features:

- Simple interface for easy navigation.

- Budget tracking and expense categorization.

- Customizable budget periods.

- Pricing: EasyBudget is available for a one-time purchase fee, making it budget-friendly for long-term use.

Features to Look For in Finance Apps

When considering Mint finance alternatives, it's essential to evaluate various features that can enhance your financial management experience. Here are some key features to look for:

- User-Friendly Interface: The app should be easy to navigate and visually appealing.

- Customizable Budgets: Ability to create and modify budgets based on personal financial goals.

- Automated Tracking: The app should automatically track transactions and categorize expenses.

- Investment Tracking: For those interested in investments, a tool that provides investment performance tracking is beneficial.

- Security Features: Look for apps that offer secure data encryption and privacy controls.

Conclusion

In conclusion, exploring Mint finance alternatives can lead you to discover tools that better suit your financial management needs. Whether you prefer the discipline of You Need A Budget (YNAB), the investment tracking capabilities of Personal Capital, the simplicity of PocketGuard, or the straightforward approach of EasyBudget, there is a solution for everyone. Understanding the unique features and benefits of each option can empower you to take control of your finances effectively.

We encourage you to explore these alternatives and find the one that resonates with your financial goals. Share your experiences and thoughts in the comments below, and don't hesitate to check out our other articles for more insights into personal finance management!

Thank you for reading! We hope to see you again soon as you continue your journey toward financial literacy and empowerment.

- Carol Luistro Obituary

- Brandon Steven Net Worth Forbes

- Did Kamala Harris Used To Date Montel Williams

- Yololary Onlyfans

- Sophie Rain Spiderman Erome

- Sophie Rain Naked

- Heather Robinson Tim Robinson

- Desirulezco

- Molly Roloff Kids

- Porn Camilla Araujo